“Buy the Dip” in Prices for High-Ticket Dropshipping Stores

In my last note to you I implored you to, “Never Waste a Crisis”.

I explained that I thought it would be a difficult market in 2023 and 2024 for both operators and sellers of high-ticket dropshipping stores. But this would be a tremendous opportunity.

Today I’m writing to tell you how I personally have taken advantage of the ‘Crisis’ by buying a store!

I encourage you to do so too.

Some Background

High-ticket dropshipping products are very much discretionary items for consumers. Sales have suffered in 2023 with many stores down 25% to 40%. Some even more.

My bet is this will slowly return to some more normal level and I’m looking for gems to buy, but de-risking the purchase by buying cheaply and on favorable terms.

Having worked on Wall Street for four decades I have learned that forecasting the economy is an art. The best you can do is plan for the worst case and buy assets at a big discount, hopefully with known problems that can be fixed.

I may be early but I have already made my first purchase and I’m excited to share the rationale and the metrics.

Economic Backdrop

While many companies have made employment cuts, the economy is still chugging along. Recession odds are low with many thinking of just a “slowdown”. Inflation is dipping but bets are it will remain stubbornly above the levels seen from the GFC to The Pandemic.

Recently Bloomberg ran an article comparing the economic winners and losers so far in 2023. “Revenge travel and entertainment”-including airlines and hotels, and restaurants –has done really well this year. In fact, the airlines have been in the news due to execution problems in both the US and Europe.

According to the article, what has not done well is:

• Durable goods (plus their supply chains)

• Sectors sensitive to interest rates

• Services exposed to corporate belt tightening.

Going forward, most economists expect inflation to be sticky. The consensus seems to believe that the economy will slow down, but not enter a deep recession. In short, the general economy may well look more like much of the 90’s and 2000’s- which more normal than 2010 to 2020.

Warren Buffet doesn’t forecast the economy, so I won’t’ either. But like Warren, I want to buy good businesses on the cheap!

HTDS Deals

In November 2021 I listed a store we own for sale with a website broker for 46X monthly sales (±$150,000). That’s the highest multiple I’ve ever seen over the last decade or so.

With my retirement in June 2022, I figured it would be nice to bank some cash. But with the stock market implosion in 2022, the buyers disappeared!

What I learned (again) is to be early in buying/ selling.

Recently I have observed several stores sell through brokers at around 30X monthly earnings, down over a third from two years ago.

However, the real deals are in the private market where stores often sell for 12X to 20X multiples of monthly earnings.

Two Critical Factors for a Good Deal

Motivated Sellers. In illiquid markets, motivated sellers understand that in order to do a deal both price and terms are negotiable.

People can be motivated because they either need the money or don’t have the time it takes to run the store.

In the case of the former, younger folks want to stretch to buy a home or may have a new baby on the way–or both. I have had several sellers take new jobs and need to focus all their time on a career.

Pristine stores or known problems. In the stock market, the best buy in a horrible market about to rebound is always the leader. Think of Apple stock (AAPL) as the avatar for the type of store that would command the high end of any valuation range. It’s the Gold Standard.

The alternative is to look at a ton of stores and pinpoint a problem you diagnose and can fix.

But this profile of deal is riskier and should be valued at the low end of the valuation range and come with great terms. I’d also commit less money to this deal as a further risk management constraint.

My Recent Purchase

A friend and client who is absolutely crushing it in his day job just wanted out of his store.

His pain point is to quickly release his time and mental bandwidth to his job as a senior executive. His bonus, which is a big part of his compensation, is paramount to focus on.

Analysis

While I’have known the store for three years, I had not looked at the particulars in a while.

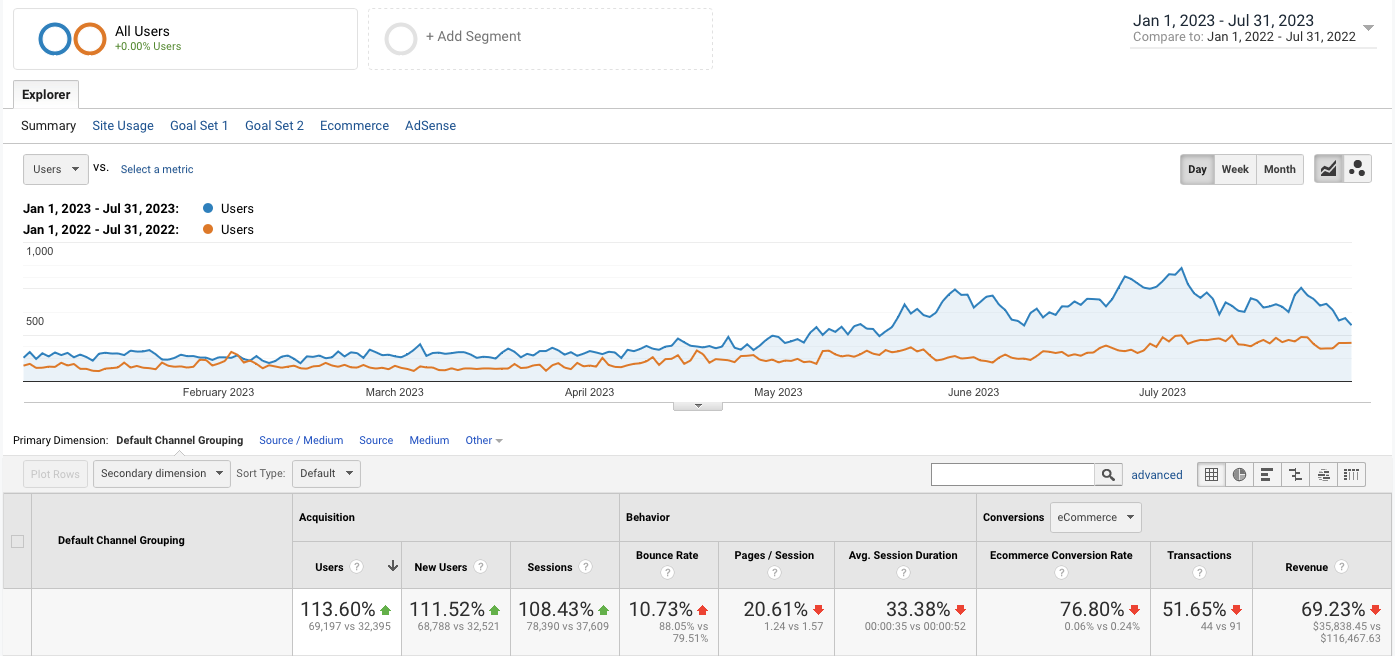

When I did I was shocked to see his traffic up over 100% from 2022, but his revenue down 69%.

So shoppers doubled over the last year, but purchases declined by nearly 70%? Why?

Here’s a screenshot from Google Analytics:

On further examination I discovered his best selling product was not showing on Google Shopping, because of a problem with Goggle Merchant Center.

Essentially, the product had been invisible to Google!

Last year he made 28 sales of this product and this year he had made 1 before I fixed it for him.

He quickly made another seven during closing our transaction! Let’s hope this continues.

Deal Terms

Our deal valued the store at 15X monthly earnings for 2023. He received no credit for the lost sales of his top product.

As he does not need the proceeds of the sale, I also negotiated an installment sale. I agreed to pay him in six equal monthly installments.

This means I avoid the big check up front. But I’m sure I’ll come out of pocket monthly depending on the store performance.

We closed on July 31st.

Potential Return

I think I can get the store earnings to 20% above last year over the next few years using my bag of tricks.

If I can sell also at 30X monthly earnings, the store’s value will increase 9X. For sure that’s a moonshot number, but certainly not impossible.

But I’m really a cash flow investor. That’s my focus. Also, like Warren Buffet, I’d love to hold this forever.

Recap

This isn’t a big $ investment, but it’s also not an Apple. I have something I have identified to fix.

My opportunity is to figure out how to convert the massive increase in traffic. And I already have three initiatives in process of being implemented.

I continue to look at deals every week.

How about you?

In 2013 I realized my need for income would extend well beyond my corporate career. I analyzed as many online business models as I could identify to solve for this need for income.

I identified high-ticket dropshipping as the online business model I like most.

Want to leave your crummy job? Want to build a runway to retire? Need some more retirement income like me?

Please reply to this email!

Ian Bond

Paphos, Cyprus

August 15, 2023

Learn More About Smart Website Investing

Success! Now check your email to confirm your subscription.