Why E-commerce Websites are a Screaming Buy in 2021

Two years ago, the public equities markets declined nearly 20% from the beginning of October through the end of December. But website brokers continued to tout their listings based on trailing 12 month’s profits. I realized the stock market was signaling concern about the 2019 economy after four rate increases in 2018 and I wrote about it here. Fortunately, the Fed responded by aggressively lowering rates and economic growth re-accelerated starting in Q2 2019. Everything turned out ok for website investors.

Today a very different paradigm exists in the website investing world. Public tech stocks have rallied immensely–30% to 50%+– driven by their strong earnings and a huge expansion of their earnings’ multiple. Meanwhile private websites for sale have had solid earnings growth but earnings multiples have been marked up very modestly. As an example, one of my clients just closed on an e-commerce site for 28 times monthly earnings that may have traded for 24 or 25 times only a year ago, up only 12% to 16.6%.

The end result is that the valuation gulf between public equities and income earning websites has expanded making this asset class more attractive than ever. In 2021, I believe an unprecedented opportunity exists today in website investing and the most attractive model is e-commerce websites, specifically high-ticket drop shipping. Here’s the case I’ll make.

Some History

As a wealth manager for over four decades, I’ve looked at emerging asset classes for a long time. Among other barriers, they usually lack the quality information to inform a decision. Starting in the 1980’s this was the case for international equities, junk bonds, and private equity strategies. Individuals are often first to discover outsized returns investing in these assets. Then slowly institutional money trickles into the investable (read larger) sectors of the asset class.

It’s fair to say that five years ago, when I first invested in drop shipping sites, there was little or no institutional capital investing in any of the online monetization strategies. Today it is a very different story, with numerous private equity funds looking at larger deals where they can scale best practices and reap outsized returns. Wealthy individuals and family offices are funding most of these smaller PE funds, as their size still is too small for the major endowments, much less sovereign wealth funds. But this is a very typical start for an asset class like website investing to go mainstream.

It’s Just Math

One of most relevant features of income producing websites is very high earnings yield. A website trading at 30 times monthly earnings returns 40% of the purchase price each year. This is the incentive to own and operate a private business in a riskier asset class. But all things being equal–and I’ll argue websites have gained huge advantages– earnings multiples should rise when interest rates decline. This is pretty simple bond math.

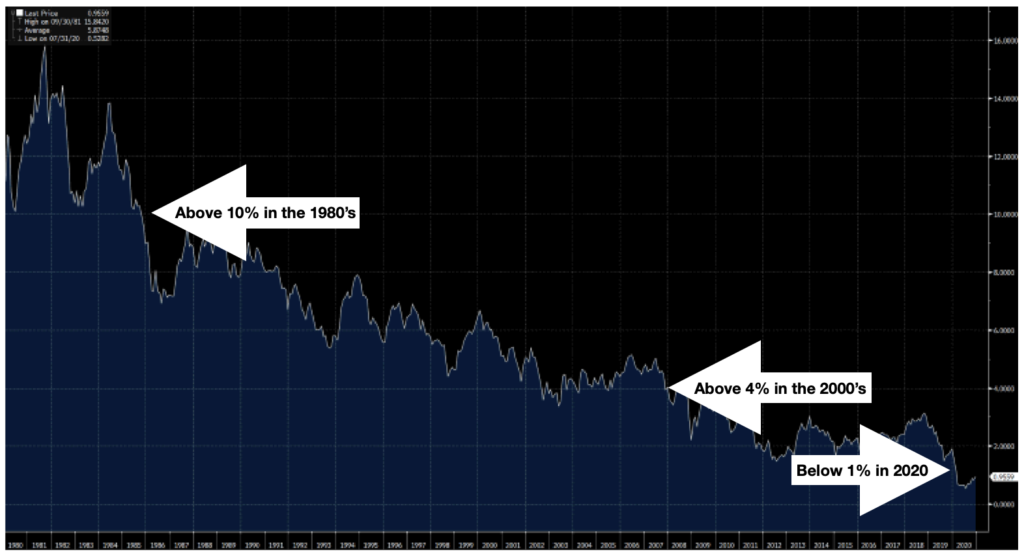

Long-term interest rates, measured by the 10-year US Treasury note yield, have collapsed from 2.6% at the end of 2018 to about .90% today. That’s 170 basis points on a base of 2.6%, or about 65% lower rates in two years. Said differently, it takes almost 2.9X more capital to generate the same cash flow return investing today than it did in 2018! That’s a massive change in the incentive to own income producing websites.

Described yet another way, Baby Boomers I know often benchmark out at a $3000 Social Security check awaiting them when they retire. Mostly, they don’t feel 65% wealthier today. However, their bond portfolios can’t be re-invested at the rates they were purchased at. Further, if they go to price a fixed annuity to replace that lost income, it will cost them based on where the market thinks longer-term rates will go. And the insurance companies pricing this risk are VERY rational.

Below is a graph of the US Government 10-year yield since 1980. Yields have gone down in a stair-step fashion for four decades. Income replacement is much more expensive today than 2018 and will remain so.

US Government 10-Year Yield Since 1980

Can This Continue?

With a disconnect between public and private market multiples, the single biggest execution risk is whether the earnings streams will continue. For physical goods, it is easy to imagine that 2020 experienced a surge in online sales that will not continue once the globe is vaccinated. Countering this is the notion that for at least the last decade, US consumers have been increasingly using time-saving techniques to refine their lifestyle. Online shopping only became a necessity when the pandemic-threatened health or local governments required folks stay at home.

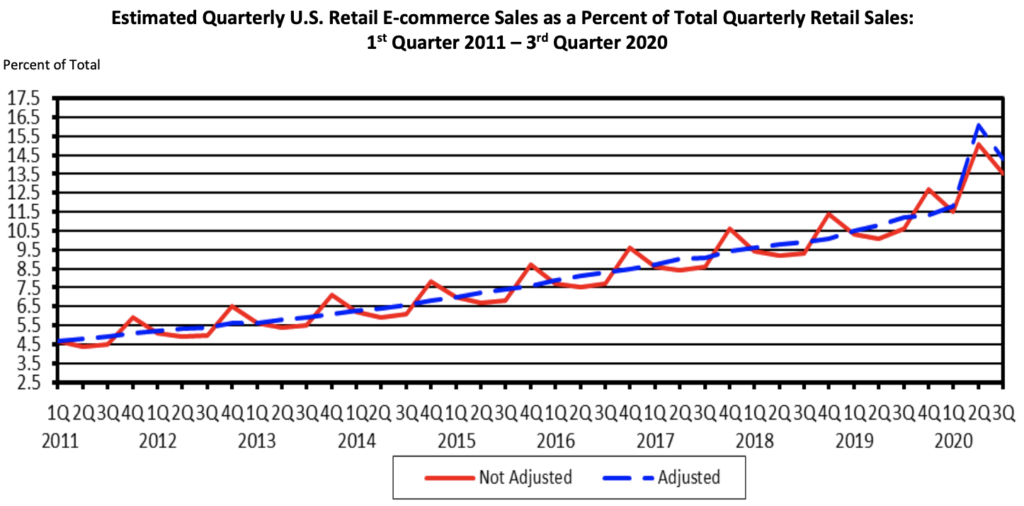

E-commerce as a percentage of sales varies by retail segment, but many believe a decade of e-commerce adoption was squeezed into 2020. The US Department of Commerce just released quarterly retail e-commerce sales. Unadjusted e-commerce sales in the third quarter of 2020 accounted for only 13.5% of total sales, up 37.1% from Q3 2019. The adjusted number was 14.3%. At year end 2019, this percentage stood at only 11.3%. As a point of reference, e-commerce sales were below 5% of total retail sales as late as 2012.

It seems fair to say that soon experiences like travel and meals out should rebound with a vengeance. It’s more of a stretch to say that people will revert to standing in crowded lines to purchase everyday items. I’d be much more worried about the online shopping trend reversing if the absolute percentage of sales is much higher. I firmly believe the trend will accelerate, not reverse. Amazon has conditioned people to spend $200 online and those of us selling higher priced merchandise will benefit as more US consumers embrace e-commerce, like they have for the last decade.

It’s All About the Supply Chain

Physical goods retail is usually broken down into FBA, Amazon affiliate, and drop shipping. There are some folks that are vertically integrated manufacturers/retailers of their own goods, but these are few and far between. I’ve been very critical of FBA as a business model because of the increasing capital that success requires. Stories here are legendary. Similarly, Amazon affiliate sites rely entirely on Amazon to pay them. I have an aversion approaching hatred for relationships like this and have suffered dealing with Houzz.

Amazon Routinely Pulls the Rug From Under its Sellers

In the spring of 2020 Amazon did two things that shocked the physical goods retail world. First, they rightly prioritized essential items over non-essential items, literally shutting down the revenue of many FBA sellers I know. Capital was trapped in China in work-in-process inventory. Forums of these FBA gurus talked about securing Government PPP loans (they are always cash poor). Many also had to deal with their tenants as they were smartly trying to develop other sales channels and they owned warehouses. Unfortunately, many had tenants who were also FBA guys and under similar pressures. When ten-year bull markets end, many lessons are learned about business fundamentals.

Second, Amazon cut by 60%+ the commissions they paid to affiliate marketing content sites that send them buyers. After a furor in this world, much soul searching was done and alternative affiliate relationships were sought out. Some succeeded in replacing Amazon while others did not. Shocking to me is that Amazon affiliate only sites are still selling in a robust fashion. My only guess is the greater fool will only be known when Amazon eliminates these commissions and this business model.

Why High-ticket Drop Shipping Wins

The most out of favor business model for the past few years has been drop shipping. It doesn’t possess the Ferrari-like returns of FBA, or the operational simplicity of a content site sending traffic to Amazon. Drop shipping may be the world’s oldest retail business model, but it doesn’t get any respect.

But high-ticket drop shipping does offer some amazing characteristics that make this the most attractive business model in 2021 and beyond.

First and foremost, high dollar tickets mean high dollar margins. We often make $250 to over $1000 per sale in our stores. You don’t need tons of volume to earn a nice semi-passive income with this business model. This also isn’t cheap Chinese merchandise that will flood the market. And a high-ticket drop shipping business isn’t complex to set up and run.

As mentioned earlier, high-ticket drop shipping will be a huge beneficiary in 2021 and beyond because of the boom in ecommerce adoption. Lower ticket products likely benefited much more in 2020 than higher ticket purchases. This is consistent with trends over the past several years.

We are experts in very narrow niches. These products typically cannot be purchased locally, and they have some complexity. This requires great content to support our product lines, which we have crafted to attract visitors to our sites, creating a very nice business moat. But customers need to get more comfortable online, which is exactly what has happened in 2020. So, the best is yet to come.

Our Suppliers Relied On Us In 2020

Second, we deal with US based suppliers who source their products globally. They are specialists in the design and manufacturing of their products, but they are not retailers. But during the pandemic our suppliers have often been out of stock. It’s been terribly inefficient and costly for them. Despite their high volumes, in normal times they could have been much higher. One of our suppliers just had a container of their most popular, and now out of stock, SKUs sent back to Western Asia for an undisclosed ‘to us’ reason, which is a first for this supplier.

As our suppliers struggled in 2020 with their own capital issues, we “pre-purchased” some of their in-stock inventory at nice discounts to fatten our margins. The beauty of this was two-fold. First, we strengthened our relationships immensely by giving capital to our suppliers. Second, we often increased our margins by as much as 50%. This was definitely a win-win for us, and we never stretched financially as we usually sold this inventory in a month and never took delivery of the inventory.

Great suppliers are the limiting constraint in this business model and soon they won’t accept any more retailers. In conversations with our over 100 suppliers, most want a much greater exposure to e-commerce. So, seasoned drop shippers hold a huge imbedded advantage. We have a track record in 2020 with our suppliers and have, in many instances, been a significant chunk of their sales. Also, most of our suppliers are constrained by the number of retailers they can deal with.

I’m certain more e-commerce only guys like us will compete, but the number of new retailers’ suppliers will accept is finite. It won’t explode because suppliers can’t physically handle it.

Virtually No Financial Risk During a Global Pandemic

Third, drop shipping is “capital light” and doesn’t require inventory or warehouses. While our suppliers are earning much better margins, the risks they run are much higher. They bear the inventory risks and the costs of carrying warehouses and staff. Our major ongoing costs are outsourced staff and the websites we maintain. Customers pay us before we ever place an order.

Not having bankruptcy risk during a pandemic is a huge advantage of any business model, not just drop shipping. We never lost a moment of sleep over a business issue during the pandemic, which is not something more complex models can claim. And we also have had a record year.

The Best is Yet to Come

In 2021 and beyond, what excites me the most about high-ticket drop shipping is the Amazon ripple I expect. I imagine a year where we start off with better supplier relationships. Our suppliers have sorted out supply chain issues. New online shoppers suddenly feel emboldened to spend $500 to $10,000 on our sites, as the pandemic and Amazon have trained them to shop online.

In 2021, demand for high-ticket purchases online will continue to grow aggressively while supply becomes abundantly available. With a 10-year US Treasury rates remain around 1%, earnings’ multiples can easily grow by 50% in this environment. What’s exciting is these sites are worth even more than the valuations this implies.

Cha- Ching!

6 Comments. Leave new

Thank you Ian for this insightful article. I think the arguments and logic you present make a whole lot of sense.

Thanks Neil! I think this is a huge trend and it’s still very early for investors. There’s a ton of money to be made and we really just got a big dose of validation.

As someone who is currently working through the DSL program, I am.concerned about your points regarding suppliers getting tighter with approving more retailers. It makes sense but also makes me take a 2md look at if I should be building a site or looking to buy a preexisting one. Obviously building vs. buying has a lot of advantages but only if you can get suppliers on board. Of I did want to buy, I have no idea how to fund a purchase on a non brick and mortar business with no physical assets.

Suppliers like dedicated online retailers who have a plan to help build their brand. Wayfair and others are brutal to deal with and do a poor job. The mission of a builder is to develop that proposition for the suppliers–they’s the critical piece of the equation, not attracting the buyers.!

Ian, excellent article, so in your opinion:

1. sales of expensive items online should go up with consumer confidence rising post COVID as well as incomes.

2. COVID 19 conditioned a whole new generation to buy online and even expensive things (Baby Boomers are big customers of high ticket items)

3. Suppliers still want good online retailers, yet barrier to entry exists due to at some point suppliers will not take new suppliers as they cannot handle that many.

4. As increases in top line revenue and hopefully net revenue increase, at the same time earnings multiple on valuation / sale / exit should increase, as rates increase?

example 5m in sales becomes 7.5m, profit goes from 2 to 2.5m, earnings multiple goes from 27x to 37x monthly profit, so huge net profit increases and exponential business valuation.

I was already sold on High Ticket Dropshipping, but this is PROFOUND!

Love this article!

HiGeorge! It’s a full out bull rush by the American consumer right now. Our biggest problem is that inventory is constrained as supply chains are stressed everywhere. I think 2022 will see a lot of pent up demand fulfilled, as it won’t all get done in 2201.